Investor activity has been severely impacted due to current economic conditions and market trends – looming recession, rising interest rates, and tighter lending standards. According to CBRE’s U.S. Investor Intentions Survey, these factors have affected purchasing activity in 2023 when compared to 2022 levels. Due to market uncertainty and shifting pricing dynamics, 60% of respondents say they will sell less than last year or not sell at all.

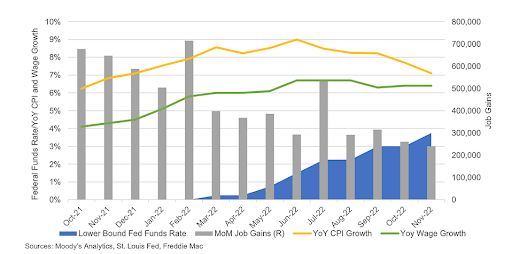

We might not see the Fed reverse its current rate hike strategy but many believe that it is likely that a pause is coming toward the end of the year due to cooling inflation.

As noted by CBRE, the average multifamily cap rate has increased by 113 bps since Q1 (‘22) and additional cap rate expansion is likely as the Fed continues to raise rates, and as lending requirements continue to tighten. With changing market dynamics, investors that are well-capitalized may have the opportunity to acquire opportunistic and distressed assets.

Strong Markets Fundamentals

When investing in real estate, it is critical to understand the market or area where you are going to invest. Due to current market dynamics, it is critical to know which market is performing best and which are in high growth areas. High-growth primary markets across the sunbelt are expected to perform best. This is in large part due to the number of individuals that are moving into these markets, the jobs moving into the markets, and household formation numbers, among other factors.

Conclusion

At the end of the day, only you can determine whether real estate investing is right for you. As a starting point, think through your personal circumstances and the aforementioned considerations. Know that every investment strategy will be different, that each investment strategy has its own pros/cons, and that all investing carries a risk so as you continue to gauge whether you should invest in real estate, do your proper due diligence.

Investing in Real Estate comes with several advantages. Navigating the real estate investing process can be difficult, but you do not have to do it alone. We are here to help.

How You Can Get in On the Action

Cash Flow Champs is a privately held investment company that focuses on acquiring and managing opportunistic and value-add multifamily real estate properties. The company specializes in repositioning well-located assets in emerging markets surrounded by positive demand drivers such as population growth and job growth.

Cash Flow Champs partners with entrepreneurs and busy working professionals interested in investing in real estate but who lack the time to navigate the process. Alongside our partners, we aim to bridge purpose and profits in a manner that allows us to improve the lives of the residents in our communities and the neighborhoods where we operate.

In the words of Robert Kiyosaki, the poor and the middle-class work for money. The rich have money work for them. If you are an individual that wants to build and maintain generational wealth through real estate, all while making a positive impact on the lives of residents and the communities where you invest, we’d love to explore opportunities for synergies.

Schedule a brief call with us so we can get to know you better, understand your life goals, and to determine where synergies may exist.

This information presented on this site is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities in the company or any related or associated company and is not a recommendation to pursue a specific investment opportunity. Any such offer or solicitation will be made only by means of the company’s confidential Offering Memorandum and in accordance with the terms of all applicable securities laws and other laws.